PURE EDUCATION • ZERO COMMISSIONS • ZERO ASSET FEES

PURE EDUCATION

ZERO COMMISSIONS

ZERO ASSET FEES

Upgrade Your Decision Making

Our 90-minute online masterclasses sophisticated investors seeking precision.Master Institutional-grade frameworks. Capture risk premia across markets. Implement Liability-Driven Investing. Optimize for tax & human capital.

Access is free via application.

When "Good Enough" has become vastly inadequate.

The hidden costs and uncompensated risks draining the potential of sophisticated investors.

You've done the hard work. You have a portfolio. But it's not perfect. That nagging feeling persists: Is it truly optimized?For many sophisticated investors, "good enough" just doesn't cut it. Hidden fees, tax drag, and uncompensated risks can predictably erode hundreds of thousands from your net worth over time.Worse, you worry that in trying to optimize, you might actually make things worse. In this sea of complexity, you ultimately don't know which "improvements" are truly evidence-based and which are just dangerous distractions that could derail your strategy.

The Strategic Session: Your Path from 90% to Optimized.

Filtering the Noise. Engineering Peak Efficiency.

Achieving peak efficiency (the final 10%) isn't about starting over; it's about iterating on proven concepts and capturing the nuance. We build upon the proven foundation that got you to 90%, applying rigorous, evidence-based frameworks to identify and eliminate the hidden inefficiencies: revealing the truly optimized structure within your portfolio.Because achieving true optimization requires eliminating every unnecessary drag on returns. Paying a recurring 1% advisory fee is fundamentally incompatible with this goal. That fee alone often negates the very basis points of efficiency we work so hard to capture.The Strategic Session is designed to give you the unconflicted knowledge and repeatable systems to achieve that final 10%, putting you firmly in control.

How The Program Works.

The Strategic Session: A Clear Framework

What: An invitation-only, live online masterclass designed to equip experienced investors with the institutional-grade frameworks for achieving peak portfolio optimization (the final 10%).

Who: For Rational Investors in Europe already managing their own portfolios who seek to eliminate hidden inefficiencies. You'll learn alongside a curated group of 15-20 experienced peers in a focused environment. (This is a group session, not 1-on-1 mentoring).

Objective: To equip you with the institutional-grade frameworks needed to eliminate hidden inefficiencies and confidently achieve the final 10% of portfolio optimization.

Format: A focused 90-minute live online masterclass, structured as 60 minutes of framework delivery followed by 30 minutes of interactive Q&A. Designed for maximum impact and efficiency.

Access: Via application but free. Confirmed dates for the next session are provided upon acceptance to ensure a cohesive group. Attendance is strictly capped.

Location: Delivered live via a Google Meet session.

Topics Covered

Advanced Portfolio Construction: Beyond simple diversification.

Human Capital Integration: Aligning investments with your most valuable asset.

Systematic Factor Investing: Capturing proven risk premia.

Peak Tax & Location Optimization for European Investors.

Liability Matching: Architecting for specific future goals.

The session will conclude with a 30-minute Q&A.

A Different Approach, Built on Education and Integrity.

Because the Best Steward of Your Capital Should Be You.

After 7+ years inside the financial industry here in Luxembourg, from fund audit to managing ETFs, I saw a fundamental problem: the system isn't always designed for your success. Too often, sophisticated professionals see their hard-earned wealth eroded by hidden fees, complex jargon, and advice conflicted by commissions.

Romain Lucas, Founder, Smart Money Growth

I believe you deserve better. I believe the knowledge to confidently manage your own capital shouldn't be a closely guarded secret or require navigating a predatory system. It should be accessible, transparent, and empowering.

So I quit. and founded Smart Money Growth

Smart Money Growth is build to be the unconflicted, evidence-based alternative I wished existed when I started. My mission isn't to manage your money, but to give you the clarity and frameworks to become the sovereign architect of your own wealth.We do this through pure education, on ETFs, passive investing, and personal finance. The practice is built on a single, non-negotiable principle: zero commissions, zero conflicts. My only incentive is your success – equipping you with proven principle and models so that lets you be the steward of your own capital.

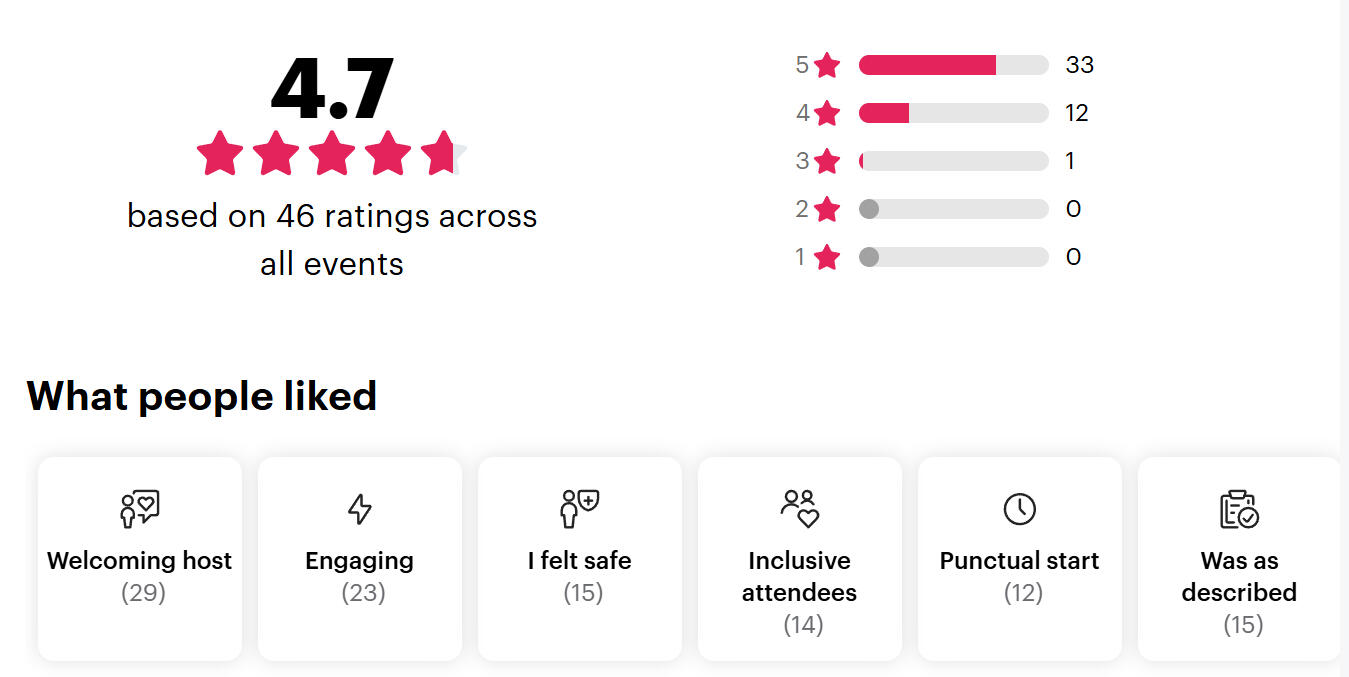

Trusted by a Growing Community of Serious Investors

Frequently Asked Questions

Are you Ready to take the next step?

© 2026 Smart Money Growth. All Rights Reserved. Smart Money Growth and Romain Lucas provide solely provide general investment education for informational purposes and do not provide investment services. The information shared on this website, the guide, during workshops, mentorship sessions, consultations, verbal communications, or through any other content is for informational and educational purposes only. The information presented should not be construded as legal, tax, or investment advice. The information presented does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. Investing in the financial markets involves the risk of loss. You should always consider your individual circumstances carefully before making any investment decisions. All investment decisions remain your own responsibility. Past performance is not a reliable indicator of future results. If you require personalized financial advice, please consult a licensed financial advisor or other qualified professional. Any calculators, or financial simulations are for illustrative purposes only and based on hypothetical assumptions and default values which may not reflect actual or future market conditions. Market, legal and tax conditions are subject to change. Testimonials and case studies reflect the experience of specific clients, result may not be typical.

Privacy Policy | Terms of Website Use | General Terms of Sale (Mentoring) | Manage Cookies